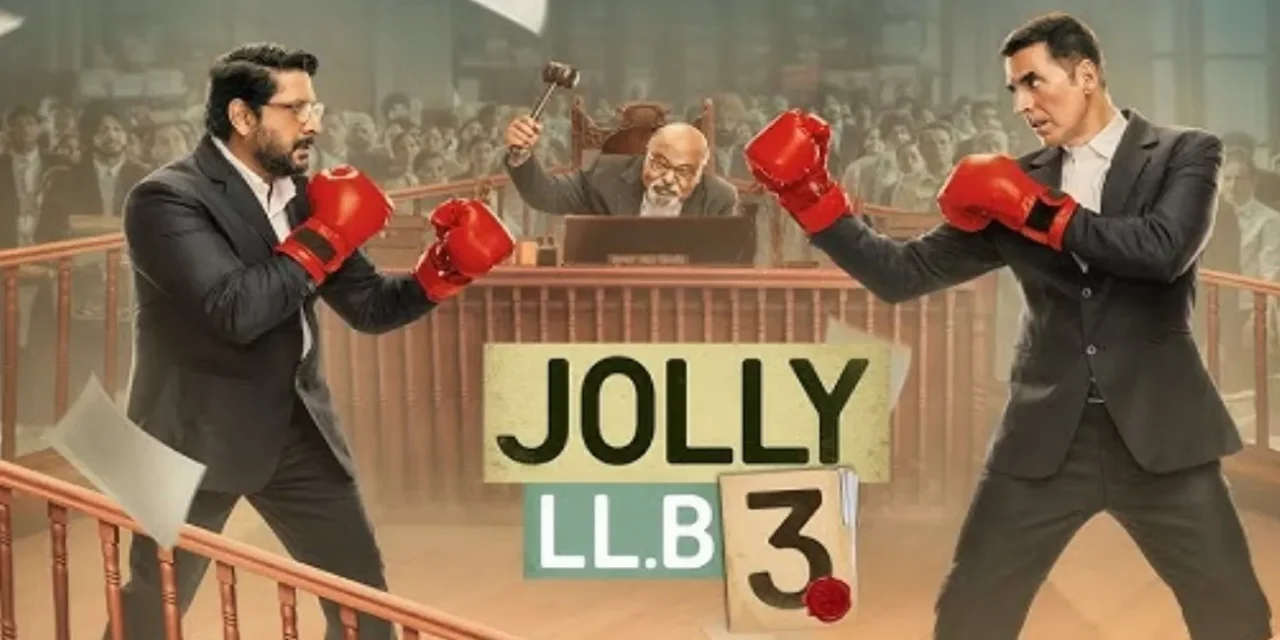

Jolly LLB 3’s OTT Deal Changes Everything — Here’s Why

Jolly LLB 3’s streaming deal breaks the Bollywood rulebook. Here’s why the film sold to both Netflix and JioHotstar — and how the dual-platform strategy paid off

The new Jolly LLB 3 movie is a big hit. Now, its streaming deal is making headlines. According to reports from Bollywood Hungama, the film’s producers made a very unusual choice. This choice could change how big movies are sold to streaming platforms.

News confirmed on November 13, 2025, reveals the movie is not going to just one platform. It is going to two.

This is a big surprise. Most big movies sign an “exclusive” deal. This means only one platform, like Netflix or Amazon Prime Video, can show the film.

Jolly LLB 3 is a legal comedy from India. It is the third film in a very popular series. For American audiences, think of it as a mix between My Cousin Vinny and A Few Good Men, but with Bollywood stars.

The movie was released in theaters on September 19, 2025. It was a box office success. It earned over 170.8 crore rupees worldwide. That is about $20.5 million.

Now, the film is coming to streaming. And the deal shows a new way of thinking in the movie business.

The Big Twist: A “Dual Platform” Sale

Most fans expected Jolly LLB 3 to land on one major platform. Instead, The Economic Times confirmed the movie will be released on two rival services.

The film will stream on Netflix and on JioHotstar (also known as Disney+ Hotstar in India).

This is very rare. As Bollywood Hungama first reported, both platforms were named in the movie’s opening credits in theaters. This means the deal was planned for a long time.

This “dual platform” or “rights-sharing” model is what makes this deal so important.

A New Strategy: Why Share a Movie?

So, why would the producers sell the movie to two competing companies? The answer is simple: more money and less risk.

The Price Was Too High for One Platform

Industry insiders say the price for Jolly LLB 3 was “astronomical.”

While the final sale price is not public, the film’s budget was high. It cost around 120 crore rupees ($14.5 million) to make. The producers wanted a big profit.

Instead of selling to one platform, they “split the rights.”

- Netflix buys the rights for its global audience. This brings the movie to viewers in the U.S., UK, and over 190 other countries.

- JioHotstar buys the rights for its massive audience in India. JioHotstar is often bundled with phone plans, so it has a huge reach.

By selling to both, the producers likely made more money than they would from a single exclusive deal. They de-risked the sale.

It’s a Win-Win for Viewers (and Producers)

This new model is a win for everyone.

- For Producers: They get two checks instead of one. They reach the widest audience possible.

- For Platforms, they share the high cost. Netflix gets a global hit, and JioHotstar keeps its Indian audience happy.

- For Viewers: The movie is easier to watch. Fans don’t have to wonder which service to check.

This is not the first time this has happened. Other films like Mimi and Tehran had similar deals. But Jolly LLB 3 is the biggest movie to use this strategy. It proves the model works.

Valuation: Why Jolly LLB 3 Was So Valuable

The reason this film commanded such a high price is all about the cast. This film was a true “event,” much like an Avengers movie for the franchise.

The “Jolly vs. Jolly” Dream Team

To understand the hype, you have to know the history.

- Jolly LLB 1 (2013) starred actor Arshad Warsi. He played a small-time, lovable lawyer. It was a surprise hit.

- Jolly LLB 2 (2017) starred a much bigger actor, Akshay Kumar. He played a different lawyer, but with the same name. This film was a huge box office success.

Fans always argued about who was the “real” Jolly.

Jolly LLB 3 brought both actors together for the first time. They face off in court as “Jolly vs. Jolly.” This was a brilliant marketing move. It made the film a must-see. This “dream team” cast made the streaming rights incredibly valuable.

The Theatrical Window: Holding Strong

Another key part of the deal is the “theatrical window.” This is the time between a movie’s release in theaters and its release on streaming.

- Theater Release: September 19, 2025.

- Streaming Release: November 14, 2025.

This creates an 8-week window. This is a very healthy and traditional window.

It shows the producers were confident. They gave the film two full months to earn money in theaters. It did not rush to streaming. This old-school strategy paid off. The film was a hit in theaters, which increased its value for streaming. A successful movie is always more valuable than a new, untested one.

Opinion & Methodology

Opinion

This isn’t just a smart deal; it’s the future. The “exclusivity” war is ending. No single platform wants to pay $50 million for one movie anymore. The bubble is bursting.

The producers of Jolly LLB 3 played this perfectly. They sliced up the rights. They sold the “Global” rights to Netflix and the “India” rights to JioHotstar.

This is a “de-risking” masterclass. They let the film prove itself in theaters for 8 weeks. Once it was a certified hit, its value went up. Then, they sold it to the highest combination of bidders. Expect to see this “dual-platform” model for every big movie from now on.

BoxOfficeWala Take

Methodology

To create this news article, our team followed a clear process.

- Monitor Breaking News: We tracked news alerts from top Indian entertainment and financial news outlets between November 12 and November 15, 2025.

- Source Verification: We cross-referenced reports from Bollywood Hungama, Sacnilk, The Economic Times, and Binged to confirm the core facts.

- Confirming the “Twist”: The key detail was the “dual platform” release. This was cited in multiple reports, based on the film’s opening credits and, later, by official platform announcements. Netflix officially confirmed the November 14 release.

- Data Analysis: We researched the film’s theatrical release date (September 19, 2025) and its final worldwide box office (approx. ₹170.8 crore / $20.5M) to establish its commercial value.

- Contextual Analysis: We analyzed the “windowing” period (8 weeks) and expert opinions on why this deal structure was chosen. The high valuation (due to the “Jolly vs. Jolly” cast) and the high cost of exclusive rights were identified as the main drivers for this new “rights-sharing” strategy. The final sale price remains undisclosed, but the reason for the deal (its high value) is the key takeaway.

Join BoxOfficeWala

Get Box Office Updates Directly on Whatsapp from Your Personal Box Office Insider

Leave a Reply